The recent agreement between Airbnb and Suffolk County marks a significant shift in the responsibilities concerning the collection of occupancy taxes from short-term rentals. This initiative is designed to simplify the tax process for property owners and enhance revenue collection for the county, which has long struggled with ensuring compliance among hosts. As local governments increasingly recognize the growing prominence of platforms like Airbnb in the hospitality sector, the establishment of such agreements reflects evolving regulations aimed at supporting tourism while addressing fiscal needs.

The Impact of the New Agreement on Suffolk County Hosts

Under the new Voluntary Collection Agreement, Airbnb will take the responsibility of remitting a 5.5% occupancy tax on behalf of its hosts in Suffolk County. This change is beneficial for thousands of property owners who previously had the burden of calculating, collecting, and remitting these taxes themselves. The move is expected to not only streamline this process but also make it more transparent, reducing confusion and potential compliance issues.

Prior to this agreement, many hosts either overlooked the necessity of collecting these taxes or were uncertain about the correct amounts, which led to discrepancies and difficulties in revenue tracking for the county. The Suffolk County Comptroller, John Kennedy, labeled this transition as a “significant milestone,” emphasizing that this partnership should lead to improved efficiency in collection efforts.

Now, with Airbnb managing the nuances of tax collection, hosts can focus on enhancing their property management and guest experiences without the added layer of administrative burden. This strategic shift indicates a growing recognition of platforms like Airbnb as essential players in the tourism sector, aligning more closely with traditional hospitality providers.

- Reduction of administrative burden for hosts

- Improved compliance and increased tax revenue for Suffolk County

- Streamlined tax processes lead to better guest experiences

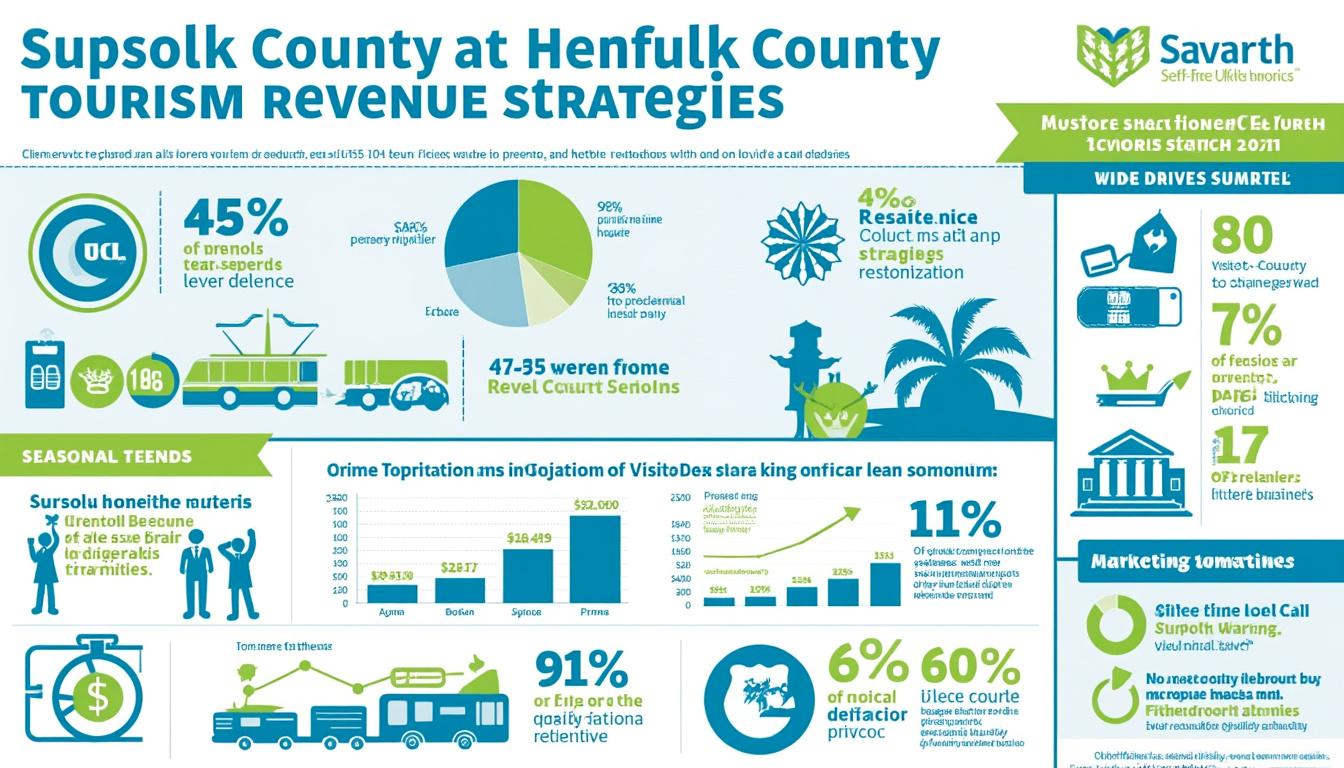

Furthermore, the county has seen an increase in revenue, with collections reaching a record of nearly $23 million from occupancy taxes in the past calendar year—an impressive 53% increase attributed to a hike in the tax rate. Such financial benefits underscore the economic significance of short-term rentals in the region.

| Year | Occupancy Tax Revenue | Tax Rate |

|---|---|---|

| 2022 | $15 million | 3% |

| 2023 | $23 million | 5.5% |

| 2024 | To be determined | 5.5% |

How the Agreement Affects Airbnb’s Business Model

Airbnb’s new role in tax collection redefines its business relationship with hosts and local government. Previously, the responsibility of tax compliance fell predominantly on the individual host, creating barriers to entry for new hosts and complicating the booking process for guests. This agreement can enhance Airbnb’s reputation as a responsible corporate citizen, eager to comply with local regulations and ensure fair practices in the marketplace.

By assuming these responsibilities, Airbnb is likely to attract more hosts who might have remained hesitant due to the complexities associated with tax compliance. Additionally, this move aligns with the ongoing trend of marketplaces acting as facilitators—similar to practices observed at platforms such as Vrbo and Booking.com.

The fact that Suffolk is the 38th county in New York to enter into such an agreement with Airbnb indicates a growing trend among municipalities recognizing the economic potential of short-term rentals. A deeper collaboration with local governments may foster a regulatory environment that benefits all stakeholders involved, from guests and hosts to city planners and tax authorities.

- Facilitates easier entry into the rental market for new hosts

- Improves Airbnb’s image as a compliance-oriented entity

- Reduces tax-related barriers for potential hosts

Challenges and Opportunities for Suffolk County

While the new agreement offers many benefits, it also presents challenges for Suffolk County. One primary concern is ensuring that this newfound efficiency translates into tangible revenue growth. County officials have stated it is still too early to gauge the impact fully, with projections suggesting a clearer picture will emerge after 90 to 120 days post-implementation.

The reliance on a private entity like Airbnb for tax collection raises questions about oversight and accountability. It remains critical for local governments to establish transparent processes and regularly assess revenue flow to ensure compliance. However, the collaborative approach may pave the way for more innovative revenue strategies that adapt to changing consumer behaviors and tourism patterns.

The county’s long-term strategy will need to account for fluctuations in tourism trends, especially considering events such as the ongoing recovery from pandemic-related disruptions. As seen in 2023, Florida experienced a record visitor influx, demonstrating the recovery potential for the broader hospitality sector.

| Challenge | Opportunity |

|---|---|

| Revenue forecasting difficulties | Potential for significant revenue increases via streamlined collection |

| Oversight of tax compliance | Collaboration could lead to improved regulatory frameworks |

| Maintaining compliance with diverse rental laws | Enhanced marketing strategies for local tourism |

The Role of Other Platforms in the Evolving Landscape

As regulations surrounding short-term rentals continue to evolve, other platforms such as Expedia, HomeAway, and Tripadvisor are also feeling the impact. Negotiations are underway with companies like the Expedia Group to establish similar agreements to streamline tax collection practices across various platforms. This coordination across platforms could standardize processes and further bolster compliance.

As more counties enact regulations similar to Suffolk’s, hosts using these different platforms may find themselves navigating a new landscape where tax collection becomes a simple part of the transaction process. Overall, this could lead to better alignment across regions, enhancing the guest experience and allowing hosts to focus on what they do best—providing excellent lodging experiences.

- Increased focus on assurance of compliance with local laws

- Potential partnerships between platforms and municipalities for improved tax collection

- Standardization of practices across different rental platforms

Future Implications for the Short-Term Rental Market

The implications of this new agreement extend beyond Suffolk County; they reflect broader trends in how local governments and short-term rental platforms interact. As municipalities recognize the fiscal benefits associated with short-term rentals, it is likely that more counties will pursue similar agreements. This trend could redefine how occupancy taxes are perceived across the country, positioning the rental market within a framework of collaborative governance.

Nevertheless, hosts should remain vigilant and informed about changing regulations. Engaging with local guidelines and participating in community discussions can ensure they remain compliant and beneficial to their neighborhoods.

Ultimately, the collaboration between Suffolk County and Airbnb not only eases the burden on hosts but may also catalyze a shift in how the entire short-term rental ecosystem operates. Building on this momentum could lead to improved tourism policies that support local economies while respecting the needs of communities.

- Stay informed about local regulations.

- Engage with community discussions and initiatives.

- Utilize tools provided by platforms for compliance.

- Monitor revenue trends and local tourism impacts.

Collectively, this represents a forward-thinking approach to harmonizing short-term rentals with community interests, fostering better cooperation, and ultimately enhancing the guest experience. The future looks promising as Suffolk County navigates this new path with Airbnb leading the charge in a rapidly evolving hospitality landscape.