As the vacation landscape evolves, the dynamics between major players in short-term rentals gain increasing attention. Airbnb’s *market leadership* continues to shape not only its trajectory but also influences other platforms. In contrast, Booking.com is carving out its path of *success*, adjusting its strategies to capture a more significant market share in a competitive environment. This visual analysis delves into the remarkable rise of Airbnb’s market share, alongside the growing presence of Booking.com, examining how these changes reflect broader *short-term rental trends* in 2023, analyzing business models, consumer preferences, and effective marketing strategies.

This exploration helps stakeholders, from property owners to industry analysts, to understand the competitive landscape in-depth, facilitating informed decisions. Insights derived from *Airbnb booking statistics* and *vacation rental comparisons* between these two tech giants offer a narrative on how consumer trust, innovation, and strategic growth are reconfiguring the short-term rental industry. With a blend of data visualizations and expert insights, readers will gain a clearer perspective on where the industry currently stands and where it might head next.

Market Dynamics: The Power of Airbnb and Booking.com

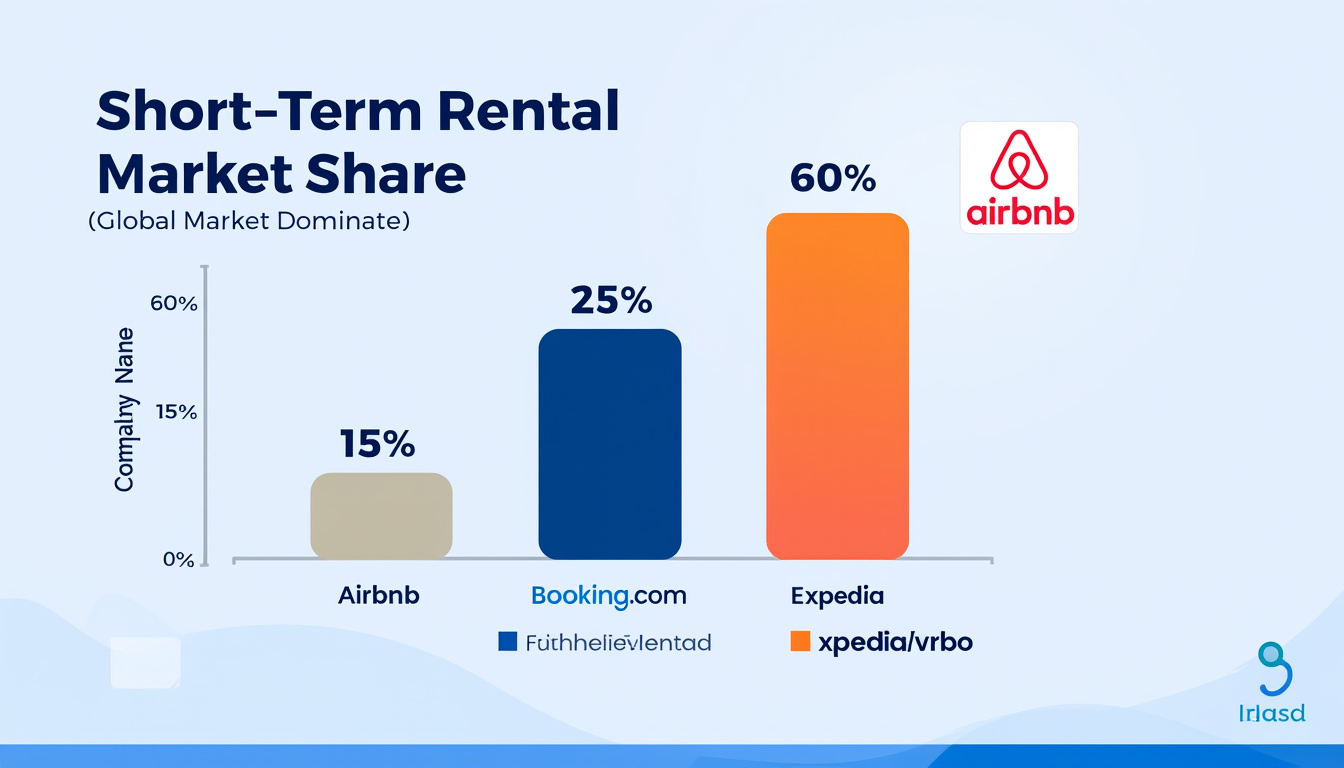

Understanding the competition between Airbnb and Booking.com requires a comprehensive look at market dynamics. In 2024, the revenue of the global short-term rental market is projected to reach $183 billion, dominated by a few key players. Airbnb, Booking.com, and Expedia/Vrbo collectively held a staggering 71% of this market, a significant increase from 53% in 2019. This illustrates not only their dominance but also hints at the increasing marginalization of smaller travel agencies and local property managers. The dramatic shift demonstrates the evolving consumer preferences towards platforms that offer integrated experiences and extensive inventories.

Airbnb: The Rising Titan

Airbnb’s *market leadership* is primarily driven by a robust growth strategy that has effectively doubled its share from 28% in 2019 to 44% in 2024. This impressive growth stems partly from its unique offerings, catering to a wide range of accommodation preferences, from luxury villas to budget-friendly apartments. Furthermore, Airbnb’s brand is synonymous with local experiences, drawing in travelers seeking immersive staycations.

The company’s innovation in incorporating flexible booking policies and enhanced safety measures during and post-COVID has significantly strengthened consumer trust. Research shows that Airbnb not only captures the casual traveler but also appeals to those needing longer-term stays, making it a pivotal player in the post-pandemic recovery phase.

Booking.com: Challenging the Status Quo

Booking.com mirrors Airbnb’s success with its own growth strategy, witnessing an increase in *market share* from 14% to 18% during the same period. The platform has primarily focused on diversifying its accommodation listings, integrating apartments and homes alongside traditional hotel offerings. This strategic shift allows Booking.com to appeal to a broader demographic, accommodating both business and leisure travelers.

Their *growth strategy* includes significant investment into enhancing their user interface and personalized user experiences. As the platform becomes more user-centric, it shifts focus toward attracting customers who might typically prefer hotels to consider alternative accommodations, pertinent in today’s travel environment where flexibility and choice are paramount.

Short-Term Rental Trends in 2023: A Visual Analysis

The past few years, particularly 2022 to 2024, have set a defining stage for how short-term rentals operate and compete. Emerging trends indicate a clear move towards integrating technology within the rental experience, changing consumer expectations and interactions. This landscape requires continual adaptation from providers like Airbnb and Booking.com.

Moreover, understanding these trends enables property owners to strategize more effectively. The modern traveler increasingly values health and safety, unique experiences, and convenience. With platforms like Airbnb prioritizing experience-driven stays, smaller rental agencies may struggle to compete effectively.

Consumer Preferences and Insights

The evolving consumer preferences are marked by a desire for personalized experiences. A recent survey highlighted that 76% of travelers prefer accommodations offering local experiences, reflecting a notable shift in priorities. This bodes well for companies like Airbnb, which successfully provides a mix of local culture and comfort.

Booking.com’s entry into this space reveals a competitive response to Airbnb’s winning formula, aiming to cultivate a similar sense of trust and locality. By presenting curated offerings that emphasize unique stays across various geographic regions, both companies actively reshape consumer interaction with short-term rentals.

table { width: 100%; border-collapse: collapse; } th, td { border: 1px solid #ddd; padding: 8px; text-align: center; } th { background-color: #f2f2f2; }

| Platform | Market Share 2019 | Market Share 2024 | Revenue 2024 (estimated) |

|---|---|---|---|

| Airbnb | 28% | 44% | $80.5 billion |

| Booking.com | 14% | 18% | $32.9 billion |

| Expedia/Vrbo | 11% | 9% | $16.4 billion |

| Others | 47% | 29% | $53.2 billion |

Strategic Marketing Approaches: Airbnb vs Booking.com

Both Airbnb and Booking.com employ distinct yet effective marketing strategies to solidify their standings in the short-term rental market. Analyzing these approaches provides valuable insights into their continued success and market penetration.

Airbnb’s marketing frequently focuses on storytelling and local experiences, translating customer interactions into authentic narratives that resonate with potential guests. Their campaigns create an emotional connection, often showcasing real hosts and guests, therefore effectively building brand loyalty.

On the other hand, Booking.com’s strategy relies on showcasing a vast array of choices, promoting its extensive inventory as a core advantage. The message highlights that travelers can find accommodations that suit any budget, preference, or location. By leveraging partnerships and robust advertisement strategies, Booking.com embraces a straightforward approach that enhances user trust.

Leveraging Social Media for Engagement

Social media engagement forms a crucial part of the marketing mix for both Airbnb and Booking.com. Platforms like Instagram, Facebook, and Twitter serve as essential tools for building brand awareness. Engaging posts featuring stunning destinations and amenities not only entice potential guests but also encourage user-generated content, providing social proof of the customer experience.

Both brands have capitalized on trends involving influencers and travel bloggers who showcase platforms’ offerings, making these endorsements powerful in attracting followers and potential customers. These authentic endorsements enhance credibility and draw increased attention to various special offerings.

Challenges Ahead: Regulatory Hurdles

With tremendous growth come significant challenges, particularly regarding regulatory landscapes. Cities worldwide are responding to the rise of short-term rentals with restrictive legislation aimed at regulating rental practices. This presents both platforms with the challenge of navigating complex compliance issues across various jurisdictions.

Regulatory changes can impact the *short-term rental landscape* dramatically, affecting supply in major cities. For example, recent rulings in European cities have sought to cap rental days per year, further complicating market positioning strategies for established platforms like Airbnb and Booking.com.

As these giants pursue expansion into new territories, they must balance the desire for growth with compliance to local standards, ensuring sustainable practices that foster positive relationships with local communities.

Future Insights: What Lies Ahead for Airbnb and Booking.com

Looking ahead, the short-term rental sector is predicted to maintain its growth momentum as consumers adapt to new travel norms. The demand for unique and personalized travel experiences is expected to thrive, providing opportunities for companies that can successfully leverage technological advancements and customer feedback.

As Airbnb seeks to evolve its offerings by incorporating more user-generated solutions, Booking.com is likely to continue its expansion strategy focusing on an equitable mix of accommodations. As platforms compete, innovation will be the keystone, driving both companies to enhance their technological capabilities to meet consumer demand effectively.

The evolving landscape mandates both organizations to stay agile, ready to adapt to shifting consumer demands, new regulations, and emerging technological trends. As various stakeholders begin to see the broader picture, collaboration and strategic formulation will prove essential in navigating the future of short-term rentals.

Through detailed *short-term rental analyses*, the insights gathered from Airbnb and Booking.com exemplify various strategic approaches, showcasing how adapting to industry trends while navigating competition leads to continued success within the sector.